Why Enduring Value Is Rarer Than Ever

Modern markets are obsessed with speed.

Speed of execution.

Speed of scaling.

Speed of monetization.

Speed of exit.

What we rarely examine is what speed destroys.

This essay is not about nostalgia, nor about resistance to change. It is about something more uncomfortable: the quiet collapse of endurance—and why longevity itself has become one of the rarest assets in modern economic life.

Not because it is impossible.

But because our systems increasingly select against it.

The Disappearing Concept of Permanence

For most of human history, economic life assumed continuity.

A workshop existed longer than its founder.

A family name carried obligations across generations.

A city grew slowly, or not at all.

Reputation mattered precisely because it could not be reset.

Markets were constrained by memory.

Today, memory has been replaced by throughput.

What matters is not whether something lasts, but whether it performs now. Permanence has been quietly reframed as inefficiency.

Yet this shift is not philosophical alone. It is measurable.

The Evidence of Acceleration

We often hear that innovation is accelerating. That is true. But innovation has a shadow: shortened lifespan.

Companies rise faster.

Brands peak earlier.

Institutions turn over leadership more quickly.

Cultural artifacts burn brightly—and disappear.

This is not a coincidence. It is a structural outcome.

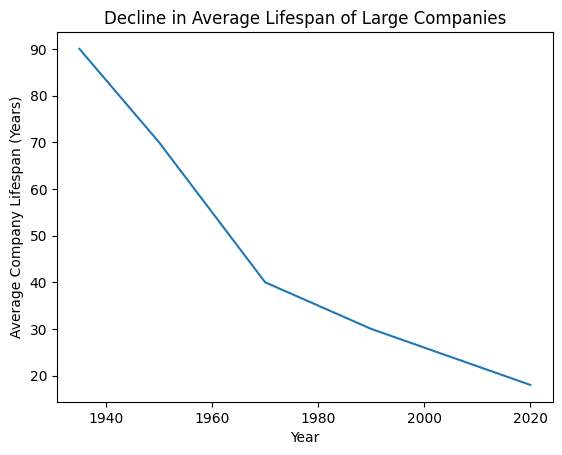

(Average lifespan of companies in the S&P 500, approximate historical estimates based on long-run market studies by McKinsey, Innosight, and academic corporate turnover research.)

What this graph shows is not merely disruption. It shows selection pressure.

In the mid-20th century, a large company could expect to exist for most of a century. Today, the expectation has collapsed to less than two decades.

This does not mean today’s firms are “worse.” It means the environment rewards velocity over durability.

Why Longevity Became a Liability

Endurance used to confer advantages:

- Institutional knowledge

- Deep trust

- Stable relationships

- Compounding reputation

Today, those advantages are often liabilities.

Long-lived organizations move slower.

They accumulate constraints.

They resist fashionable narratives.

They remember past failures.

In a system optimized for quarterly metrics, memory becomes friction.

The result is a paradox:

We produce more things than ever—and fewer things meant to last.

Concentration Without Continuity

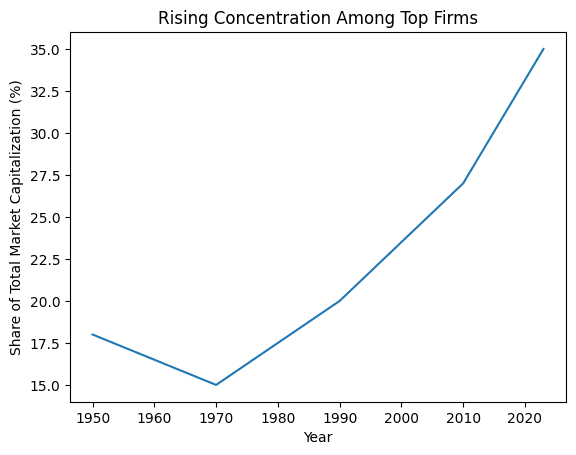

At the same time that corporate lifespans shrink, power concentrates.

This seems contradictory at first. But it is not.

A small number of entities now command disproportionate economic weight—while everything beneath them becomes increasingly disposable.

(Share of total U.S. market capitalization held by the top 10 firms, approximate figures derived from historical stock market capitalization studies.)

This is not a return to old monopolies. It is something different.

These firms dominate not because they promise permanence, but because they excel at control over flows—data, attention, logistics, platforms.

They do not sell stability. They sell access.

The Death of the Middle Layer

Historically, value systems were layered.

At the top: institutions that endured.

In the middle: enterprises built to last decades.

At the bottom: experimentation.

Today, the middle is collapsing.

Small things appear constantly and vanish quickly.

Very large things dominate infrastructure.

Mid-sized, long-term, reputation-driven entities struggle.

This has consequences beyond economics.

It reshapes culture.

Culture Without Inheritance

Cultures survive through inheritance.

Stories repeated.

Standards upheld.

Craft transmitted.

Meaning preserved.

When everything is optimized for immediacy, inheritance becomes optional.

We see this everywhere:

- Books written for relevance, not rereading

- Architecture designed for resale, not beauty

- Brands engineered for campaigns, not identity

- Language flattened for reach, not precision

This is not decay—it is design.

Systems now assume replacement, not continuity.

Why Some Things Still Endure

Yet not everything disappears.

Certain artifacts resist time.

Why?

Because they share three traits:

- They are not optimized for speed

- They carry symbolic weight beyond utility

- They reward repeated engagement

Enduring value is rarely efficient.

It is often quiet.

Often misunderstood.

Often undervalued—until it is gone.

The Economics of Memory

Markets price what they can measure.

Speed is measurable.

Clicks are measurable.

Conversion is measurable.

Memory is not.

Trust is not.

Reputation across generations is not.

Symbolic depth is not.

So systems discount them.

Until a crisis arrives—and suddenly endurance matters again.

Cycles of Amnesia and Recovery

This pattern is not new.

Periods of acceleration are always followed by periods of reckoning.

When systems become too optimized, too centralized, too brittle—they fail in unexpected ways.

And when they do, what survives?

Not the fastest.

Not the loudest.

Not the most optimized.

But the things built on deeper foundations.

What Quietly Gains Value Over Time

In environments dominated by churn, certain qualities become scarce:

- Names that carry weight without explanation

- Institutions that do not need reinvention every year

- Ideas that improve with rereading

- Assets that do not require constant signaling

These are not fashionable.

They do not trend.

They do not scale easily.

But they endure.

Why This Matters Now

We are entering a period where:

- Systems are overstretched

- Trust is thin

- Institutions are questioned

- Memory is fragmented

In such environments, endurance itself becomes signal.

Not as nostalgia.

Not as resistance.

But as proof of alignment with deeper human rhythms.

The Quiet Reversal Already Underway

Look carefully, and you can see it:

- Renewed interest in long-form writing

- Return to classical education models

- Preference for names, symbols, and forms with history

- Growing skepticism toward disposable novelty

This is not mainstream yet.

But it is real.

And it always begins at the margins.

Conclusion: Value That Does Not Ask for Attention

The most durable things do not shout.

They wait.

They accumulate meaning slowly.

They reward patience.

They grow heavier with time.

In a world optimized for immediacy, weight becomes rare.

And rarity, eventually, becomes value.