The modern economy is built on turnover. Firms are born, scale rapidly, and disappear with equal speed. Workers are told to reinvent themselves every decade. Capital is praised for its mobility, not its rootedness.

And yet, when crises arrive — financial, social, or civilizational — the structures that matter most are always the same:

- Land that cannot be outsourced

- Institutions older than any living memory

- Cultural capital accumulated slowly and defended stubbornly

- Names that still mean something long after their founders are gone

These are not fashionable assets. They are durable ones.

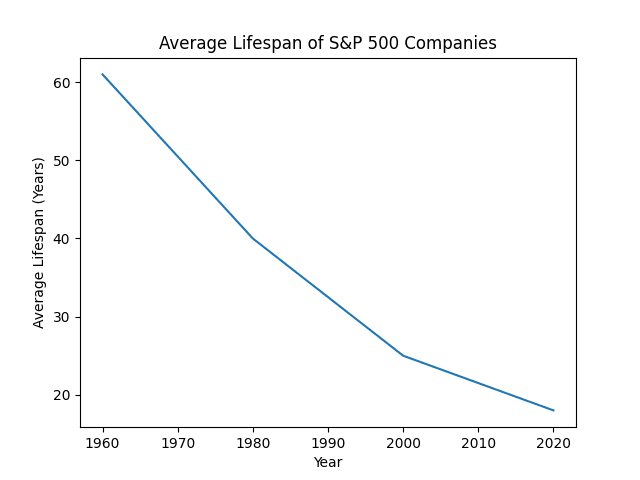

Graph 1: Declining Average Lifespan of Firms in the S&P 500 (1960–2020)

This graph shows a well-documented phenomenon: the steady collapse of corporate lifespan in the United States.

In 1960, the average company in the S&P 500 remained there for roughly 60 years. By 2020, that number had fallen below 20 years.

This is not progress. It is volatility disguised as innovation.

What the Graph Actually Tells Us

This decline does not mean companies have become worse. It means systems have become less patient.

Firms are optimized for:

- financial engineering rather than continuity

- extractive growth rather than stewardship

- exit events rather than inheritance

What disappears is not incompetence, but time.

And time is the invisible ingredient of value.

The Assets That Ignore the Cycle

While firms vanish faster than ever, some assets barely notice the turbulence:

- Prime urban land

- Linguistic and cultural capital

- Enduring institutions (universities, churches, guilds, families)

- Names that carry inherited trust

These assets operate on a different clock. They are not liquid, not fast, and not scalable in the modern sense. But they accumulate something markets cannot manufacture: recognition over time.

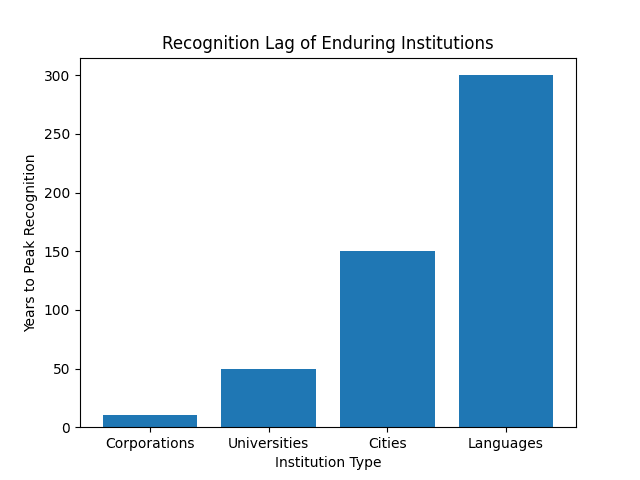

Graph 2: Recognition Lag of Enduring Human Institutions

This graph illustrates a structural reality often ignored: the delay between creation and recognition.

Land, language, universities, and long-lived family enterprises do not peak quickly. Their value emerges slowly — often centuries later.

Modern finance hates this lag. Civilization depends on it.

Why Markets Misprice Permanence

Markets excel at pricing motion. They struggle to price meaning.

Anything that requires:

- patience

- memory

- inheritance

- restraint

is discounted.

This is why the most valuable assets are often acquired quietly, held privately, and revealed late.

Europe Understood This Once

In continental Europe, value was historically embedded in:

- place

- name

- continuity

A merchant house that survived wars mattered more than a faster rival. A family name carried liability as well as privilege. Reputation was intergenerational.

Modern capitalism severed that chain — and replaced it with quarterly reporting.

The False Promise of Infinite Innovation

Innovation is real. But endless innovation without inheritance produces fragility.

Civilizations collapse not when they stop inventing, but when they forget what must not be replaced.

Capital Still Knows — Even If We Pretend Not To

Despite all rhetoric, capital itself still behaves conservatively when it truly matters.

In moments of stress, it flows toward:

- land

- infrastructure

- cultural anchors

- jurisdictions with memory

The language changes. The instincts do not.

Why This Matters Now

We are entering a period where:

- institutions will fail faster

- populations will shrink

- legitimacy will matter more than growth

In such an environment, endurance becomes the rarest asset of all.

The Quiet Advantage of the Long View

Those who think in decades compete.

Those who think in centuries inherit.

The paradox of our age is this: the more frenetic the surface becomes, the greater the advantage of stillness beneath it.

Permanence Is Not Passive

Enduring assets do not survive by accident. They are:

- defended

- maintained

- named carefully

- transmitted deliberately

Permanence is active resistance against entropy.