The secondary domain market has always evolved in cycles: from the speculative gold rush of the late 1990s, to the institutionalization of the 2000s, to the maturing liquidity of the 2010s, and now into a more global and AI-disrupted era in the 2020s. Investors, startups, and brand strategists are looking ahead with one pressing question: what will the domain market look like in 2025–2030?

This article examines the key forces shaping the next five years, using both historical evidence and forward-looking analysis. While the future is never certain, the trends are clear enough to sketch probable scenarios for pricing, extensions, and investor strategies.

1. The Continuing Supremacy of .COM

Despite over 1,000 available extensions, .com remains the global gold standard. According to NameBio sales data, .com still accounts for over 70% of reported aftermarket transactions and an even higher share of premium deals over $100,000.

The reasons for its dominance—global recognition, credibility, and habit—are not eroding. In fact, scarcity of high-quality .com domains may drive median prices upward at a faster pace than in the past decade.

- Expect the average reported .com sale to continue rising 5–8% annually.

- Median prices may move upward as fewer mid-tier domains are available and liquidity concentrates at higher levels.

- Businesses will still default to .com for international branding, especially in finance, AI, and consumer technology.

2. The Rise (and Possible Plateau) of .AI

The biggest story of the early 2020s has been the meteoric rise of .ai, driven by artificial intelligence startups. From 2018 to 2024, average aftermarket .ai sales grew by over 40% annually, with high-profile sales like you.ai and agent.ai exceeding six figures.

But how sustainable is this growth?

- Short term (2025–2027): .ai remains hot as AI investment flows continue. Expect more six-figure sales, particularly for one-word generics.

- Medium term (2028–2030): market may plateau. AI companies will consolidate, and only the strongest brands will survive. Not every AI startup can afford a premium .ai domain.

- Investors should treat .ai as a cyclical play, not a permanent replacement for .com.

3. Emerging Niches: Finance, Wellness, and Luxury

Some industries consistently pay premiums for domains:

- Finance & Wealth Management → Keywords like “wealth,” “capital,” “equity,” and “fund” remain highly sought after.

- Wellness & Longevity → Rising consumer spending in health, biohacking, and longevity research will drive demand for evocative names.

- Luxury & Lifestyle → Premium brands value uniqueness and heritage. Domains with classical or ancient language roots (Latin, Greek, Sanskrit, Egyptian) carry prestige.

Investors holding strong names in these niches should expect steady appreciation, even if broader market growth slows.

4. AI and Automated Valuation Tools

Another major trend is the increasing reliance on AI-driven valuation tools by marketplaces and investors. Platforms like GoDaddy, Afternic, and Dynadot provide automated price estimates using machine learning trained on historical sales.

- Pros: Increases liquidity by giving buyers a reference point.

- Cons: Over-reliance on algorithms can compress prices at the lower end and undervalue brandable or culturally nuanced domains.

By 2030, we may see two-tier pricing:

- Algorithmically validated “liquid” domains (short, dictionary words, common industries).

- Story-driven or culturally rich domains that resist algorithmic valuation but command high premiums from human buyers.

5. Regional Extensions: Growth but Limited Liquidity

Country-code TLDs (ccTLDs) like .de, .uk, .cn, and .in will remain strong in local markets.

- .de (Germany) continues to be the largest ccTLD after .com, with strong aftermarket sales.

- .in (India) is likely to grow as the Indian digital economy expands.

- .cn (China) sales may re-emerge as capital controls shift, though regulatory risk is high.

However, outside of .de, most ccTLDs will have limited liquidity in the global aftermarket. They serve regional buyers but are less attractive for broad portfolio investing.

6. Pricing Distribution Shifts

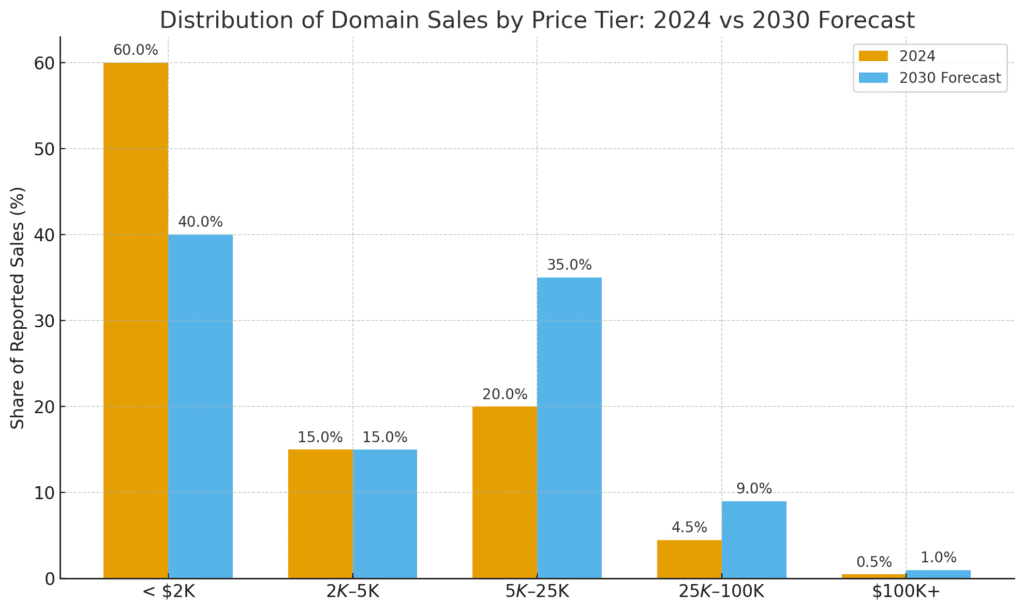

Historically, most domain sales cluster under $5,000, with a long tail of high-value sales above $50,000. This “power law” distribution will remain, but the balance is shifting upward.

- By 2030, we may see a shrinking sub-$2,000 segment, as marketplaces and AI pricing push floor prices higher.

- The $5,000–$25,000 tier will become the most active.

- High-end deals ($100K+) will still dominate headlines but remain rare (<0.5% of sales).

7. Investor Strategies for 2025–2030

For domain investors, the key is to position portfolios where demand is moving:

- Hold scarce .coms → even mid-tier one-word .coms will rise in value.

- Participate in .ai → but treat it as a cyclical, not eternal, play.

- Focus on premium niches → finance, AI, health, luxury.

- Use AI tools, but don’t trust them blindly → human judgment on cultural/brandability factors will be your edge.

- Consider liquidity vs. long-term holds → not every domain will sell quickly, but premium names will appreciate.

8. Forecast Table: Domain Market 2025–2030

| Segment | 2024 Baseline | 2025–2030 Forecast | Trend |

|---|---|---|---|

| .com (median sale) | $2,000–$3,000 | $4,000–$5,000 | ↑ Rising |

| .ai (median sale) | ~$2,500 | $5,000–$8,000 (peak 2026–27), then plateau | ↑ Early growth, then flat |

| High-end .coms | $100K+ deals rare | More frequent ($250K–$500K top range) | ↑ Steady |

| Sub-$2K sales | 60% of all sales | 40% of all sales | ↓ Declining |

| $5K–$25K range | ~20% of sales | ~35% of sales | ↑ Expanding |

| Premium niches | Strong but scattered | Stronger, finance & health lead | ↑ Focused growth |

Conclusion: Scarcity and Strategy Will Define the Future

By 2030, the secondary domain market will be shaped by two forces: scarcity and strategy. Scarcity of high-quality .coms will drive prices upward, while strategic use of data, AI, and cultural insight will separate winners from losers among investors.

The story of domains is not one of infinite expansion, but of consolidation around scarce, meaningful digital assets. For those who understand both the numbers and the narratives, the next five years will present exceptional opportunities.