Executive summary:

The secondary domain market has grown from obscure email list trades in the mid-1990s into a sophisticated global marketplace where single names can fetch eight figures. This 30-year journey can be divided into four distinct eras, each shaped by different actors, technologies, and narratives: The Pioneering Years (1995–2000), The Professionalization Era (2000–2010), The Institutional Decade (2010–2020), and The AI & New TLD Era (2020–2025).

This article explores each era in depth, examining price dynamics, landmark sales, market structure, and investor behavior. Along the way, we provide data points, a timeline, and a comparative table showing how the economics of domains have evolved.

1. The Pioneering Years (1995–2000)

Context

- The World Wide Web opened to commercial activity in 1993–1994.

- By 1995, Network Solutions (NSI) was the primary registrar for

.com,.net, and.org. Domain registration was initially free, but by 1995, NSI began charging $100 for a two-year registration. - Few companies understood the future importance of domains, leading to rampant “cybersquatting” by early opportunists.

Market Characteristics

- Illiquidity. There was no structured aftermarket. Domains traded informally on mailing lists (like

Domain-Name-Forum) or via direct outreach. - Price discovery was chaotic. Sales ranged from $1,000 to $25,000, shocking at the time.

- Legal uncertainty. The Anticybersquatting Consumer Protection Act (ACPA) passed in 1999, establishing legal remedies for trademark owners and shaping aftermarket risk.

Notable Sales

- Business.com – Registered in 1995, resold for $150,000 in 1997. A then-record.

- Altavista.com – Changed hands for around $3.3M in 1998.

- Loans.com – Sold by Bank of America for $3M in 2000 (technically at the cusp of the next era).

Investor Behavior

- Early registrants were either visionaries or speculators with little cost basis.

- Few professional investors existed; most were individuals flipping opportunistically.

Takeaway:

The pioneering years set the foundation: the realization that domains could be valuable assets independent of websites.

2. The Professionalization Era (2000–2010)

Context

- The dot-com bubble burst (2000–2002), but the role of strong domains only became clearer. Companies with premium domains survived the downturn more easily.

- Marketplaces emerged. Sedo (2001), Afternic (1999, re-launched in early 2000s), and BuyDomains professionalized trading.

- Parking monetization boomed. Google’s AdSense for Domains (2003) turned portfolios into revenue machines, creating recurring income for investors.

Market Characteristics

- Liquidity improved. Marketplaces allowed domains to be listed, searched, and transacted globally.

- Pricing norms emerged. Six-figure

.comsales became common. - Domainers as a class. Investors began calling themselves domainers, many building portfolios of thousands.

Notable Sales

- Business.com again—sold in 2007 for $345M (company + domain), symbolizing domain value’s integration into corporate identity.

- Diamond.com – Sold for $7.5M in 2006.

- Porn.com – Sold for $9.5M in 2007 (largest cash sale of the era).

- Vodka.com – $3M in 2006.

Investor Behavior

- Portfolios expanded rapidly (e.g., Frank Schilling, Mike Mann).

- Arbitrage opportunities: buy undervalued generics and monetize with parking.

- Capital efficiency: renewal costs vs. parking income created low-risk models.

Takeaway:

Domains moved from speculative toys to recognized digital assets, attracting dedicated investors and legitimizing the industry.

3. The Institutional Decade (2010–2020)

Context

- Consolidation. Huge portfolios were acquired by private equity firms and registrars.

- New gTLDs launched (2013–2016). Thousands of extensions (e.g.,

.xyz,.club,.guru) entered the market, initially hyped but mostly niche. - Parking revenue collapsed. As Google downgraded parked pages, monetization shifted to sales.

- Escrow & brokerage matured. Escrow.com, MediaOptions, and others created trust and liquidity.

Market Characteristics

- Institutional money entered. Large portfolios valued in the hundreds of millions changed hands (e.g., Rightside acquired, later bought by Donuts).

- End-user demand increased. Startups flush with VC cash paid big money for category-defining

.coms. - Valuations normalized. $500K–$2M sales became standard for top names.

Notable Sales

- Sex.com – Sold for $13M in 2010.

- Insurance.com – Sold for $35.6M in 2010.

- Hotels.com – Valued at $11M+ when acquired by Expedia (2001, but recognized later in filings).

- Voice.com – Sold for $30M in 2019 to Block.one (largest publicly reported all-cash sale to date).

- PrivateJet.com – $30.18M in 2012 (structured deal).

Investor Behavior

- Shift from parking ROI to appreciation ROI.

- Professional brokerages emerged, with outbound marketing to end-users.

- Diversification into ccTLDs (like

.de,.co.uk,.cn) as they grew in local markets.

Takeaway:

The market became institutional. Domains were treated as brand assets in M&A, with brokers and escrow bringing Wall Street-level professionalism.

4. The AI & New TLD Era (2020–2025)

Context

- Pandemic digital acceleration (2020). Startups scaled fast, many upgrading to premium domains.

- Artificial Intelligence boom (2022–2025). AI startups sought short, authoritative

.aidomains, creating the first real competition to.comin premium pricing. - Crypto & Web3 cycles. Domains tied to blockchain, DeFi, and NFT projects saw volatile demand.

- Aftermarket transparency improved. DNJournal, NameBio, and Escrow reports made comps easier to access.

Market Characteristics

- .com remains king. Still the default for global trust, but

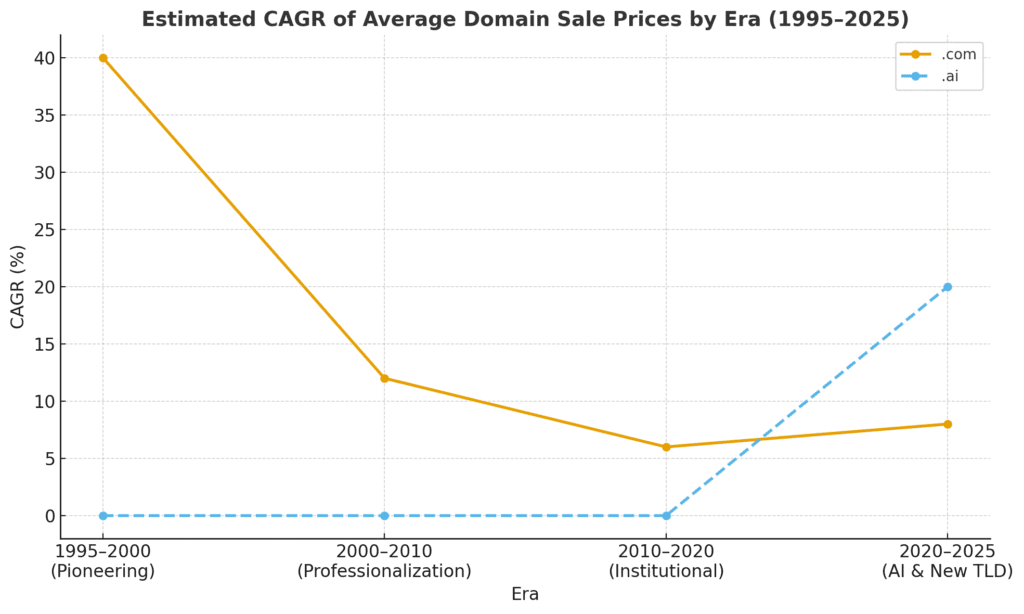

.aihas become the “VC darling” TLD. - Price appreciation. Average

.comaftermarket price CAGR ~6–8% over the decade, with.aishowing ~20% CAGR since 2018. - Alternative monetization. Lease-to-own (LTO) financing models (via Afternic, DAN, SquadHelp) made high prices accessible to startups.

Notable Sales

- NFTs.com – $15M in 2022.

- AI.com – Pointing to OpenAI since 2023 (price undisclosed, likely 8-figure).

- Zoom.com – Acquired by Zoom Video pre-IPO (paid ~$2M).

- Chat.com – Brokered in 2023 (price rumored high-8-figures).

Investor Behavior

- Sophistication increased. Investors model CAGR, STR (sell-through rate), and NPV of portfolios.

- AI terms dominate:

chat,agent,bot,ai,gen. - Strategic investors: corporations and funds quietly acquiring for long-term positioning.

Takeaway:

2020–2025 has been the era of expansion and diversification. .com is entrenched, .ai is the breakout star, and financing tools have widened buyer access. Investors now treat domains as part of diversified alternative asset portfolios.

Comparative Table of the Four Eras

| Era | Timeframe | Market State | Avg. Premium Sale Range | Key Drivers | Investor Profile |

|---|---|---|---|---|---|

| Pioneering Years | 1995–2000 | Informal, chaotic | $1K–$150K | Early adoption, no comps | Opportunists, individuals |

| Professionalization Era | 2000–2010 | Marketplaces emerge | $50K–$1M+ | Parking, Sedo, ACPA | Domainers, small funds |

| Institutional Decade | 2010–2020 | Mature, structured | $100K–$10M | Brokers, PE, end-users | Funds, brokers, registrars |

| AI & New TLD Era | 2020–2025 | Diversified, global | $500K–$30M | AI, VC, LTO financing | Institutional + strategic |

Graph: CAGR 1995-2025

Conclusion: What Comes Next?

Looking forward to 2025–2035, several dynamics will shape a possible fifth era:

- AI as identity. As AI agents become ubiquitous, domains may serve as persistent trust anchors for non-human actors.

- Fragmentation. ccTLDs and select gTLDs will thrive, but

.comremains the anchor of trust. - Financialization. Domains could be securitized or fractionalized as digital assets.

- Cultural premium. Single-word domains in finance, healthcare, and AI will retain status as rare collectibles, commanding multi-million valuations.

The four eras show a consistent pattern: domains are the root layer of digital identity, with each cycle bringing more liquidity, professionalism, and integration into the mainstream economy.