Why Prices Rise, Quality Falls, and What Markets Quietly Remember

Most discussions about value today are short, loud, and shallow. They focus on price movements without asking what price means. They talk about inflation as if it were a technical inconvenience rather than a civilizational signal. They treat markets as abstract machines, detached from memory, culture, or continuity.

That is a mistake.

Markets are not merely mechanisms of exchange. They are archives of human behavior. They remember what people try to forget.

This article is not about trading tactics or short-term forecasts. It is about something older and harder to face: why value, once detached from memory, becomes unstable — and why modern markets increasingly reflect that loss.

Inflation Is Not Just Monetary — It Is Cultural

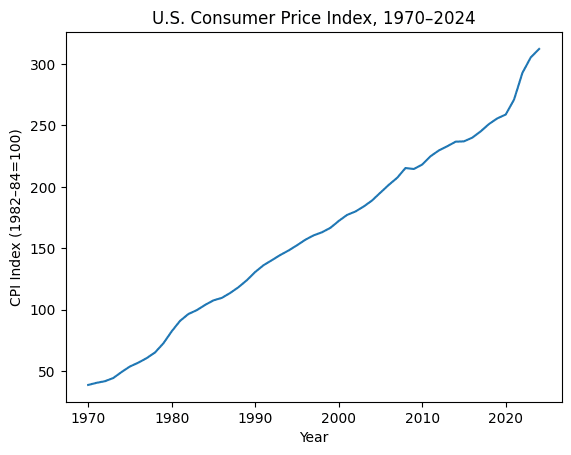

The first chart below shows the U.S. Consumer Price Index (CPI) from 1970 to 2024.

What it captures is not a mystery. Prices rise over time. Everyone knows this. But what is rarely acknowledged is how steady, how relentless, and how one-directional the curve is.

There are pauses. There are moments of temporary relief. But there is no reversal.

Inflation, in the long run, does not behave like a cycle. It behaves like erosion.

This matters because inflation is often described as a purely technical phenomenon: too much money chasing too few goods. That explanation is incomplete. Inflation persists not only because money supply expands, but because the collective standard of restraint collapses.

Historically, inflation accelerates when societies stop believing in limits.

When debt becomes normal.

When consumption replaces stewardship.

When the future is discounted aggressively — not mathematically, but morally.

Price inflation is the numeric trace of that process.

Money Supply and the Illusion of Control

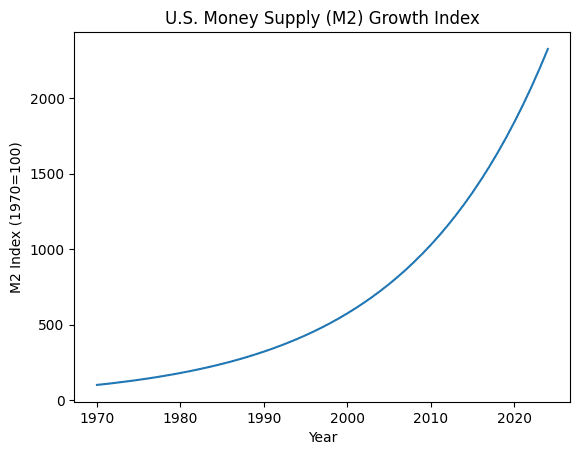

The second chart below shows the U.S. M2 money supply, indexed to 1970.

The curve is exponential. Not volatile. Not chaotic. Smooth. Confident. Unapologetic.

This is crucial.

Modern monetary expansion does not feel dangerous because it is orderly. It is managed by institutions that speak calmly, publish models, and promise stability. But exponential processes are deceptive. They feel safe — until they don’t.

For decades, money expanded faster than real output. Asset prices rose. Debt grew. Wages lagged. Each cycle required larger interventions to maintain the same effect.

This is not a conspiracy. It is not even malice. It is a structural outcome of a system that cannot tolerate contraction, because contraction would force questions nobody wants to answer.

Questions like:

What is real value?

What deserves to survive?

What should be allowed to fail?

Markets Remember What Culture Forgets

Financial markets, over long periods, behave less like rational calculators and more like collective memory engines.

They remember:

- Which assets preserve purchasing power

- Which promises are broken

- Which systems quietly rot from within

This is why certain patterns repeat across centuries:

- Hard assets reassert themselves after long periods of monetary excess

- Speculative instruments multiply when trust in reality weakens

- Narratives replace fundamentals near the end of cycles

None of this requires panic. But it does require honesty.

What we are witnessing is not simply “inflation” or “tightening” or “rate cycles”. It is the delayed recognition that value cannot be abstracted forever without consequence.

The Disappearance of Quality

One of the least discussed effects of long-term inflation is not price distortion, but quality decay.

When money expands faster than meaning, producers optimize for:

- Speed over durability

- Volume over excellence

- Compliance over craftsmanship

This is visible everywhere — not only in consumer goods, but in institutions, language, education, and even art.

Markets price what is available. They cannot price what no longer exists.

The result is a strange paradox: rising nominal prices alongside falling lived quality.

People feel poorer not because they cannot afford things, but because the things they can afford no longer satisfy.

This is not nostalgia. It is economics intersecting with anthropology.

Why This Matters for Valuation

At Valora Maxima, the focus is not on hype or immediacy. It is on what retains value when narratives fail.

Valuation, in its original sense, was never about predicting the next move. It was about identifying what survives.

Survival favors assets that:

- Are scarce in ways that cannot be easily replicated

- Are embedded in long memory rather than short fashion

- Do not depend on continuous institutional support to function

In periods like this, valuation becomes less about spreadsheets and more about judgment.

Not opinion. Judgment.

The Quiet Signal in Long Curves

Short-term charts are noisy. Long-term charts are honest.

The two curves above — CPI and money supply — are not forecasts. They are confessions.

They confess that:

- Stability has been borrowed from the future

- Growth has been substituted for depth

- Memory has been traded for convenience

Markets will adjust. They always do. But they adjust on their own timetable, not ours.

Those who treat valuation as a memory discipline rather than a trading game are usually early — and often lonely — but rarely wrong in the long run.

Closing Thought

The most dangerous assumption in finance is that tomorrow must resemble yesterday.

The second most dangerous assumption is that value can be continuously manufactured without reference to what once made it real.

Markets remember. Even when people don’t.

That is not pessimism.

That is restraint.

And restraint, historically, has always been undervalued — right up until the moment it becomes priceless.