Introduction: The Wrong Mental Model

Most observers misunderstand the secondary domain market because they begin with the wrong analogy.

They compare domains to:

- stocks,

- startups,

- cryptocurrencies,

- or other liquid, continuously traded digital assets.

This comparison feels intuitive because domains are digital. But it is wrong.

Domains do not behave like technology assets. They behave like scarce economic locations — closer to land, ports, or trade routes than to software or equities. Their prices do not update continuously; they are repriced episodically, when the right buyer appears.

Understanding this distinction is essential if one wants to understand:

- why liquidity is low,

- why prices appear “erratic,”

- and why long holding periods are not a failure of the market but a feature of it.

Scarcity Is Structural, Not Manufactured

A defining feature of land is that supply is fixed.

The same is true of meaningful domains:

- There is only one exact .com string for any given name.

- Language locks meaning.

- Cultural recognition compounds over time.

No amount of innovation can create another Hotels.com or SilverDrachma.com any more than innovation can create another Manhattan.

Unlike technology:

- domains do not become obsolete through innovation,

- they are not displaced by better “versions,”

- and they are not upgraded out of relevance.

They are positions, not products.

Why Liquidity Looks Low — and Why That Is Normal

Land markets are famously illiquid.

A parcel of land may go:

- years without a transaction,

- then reprice dramatically when a buyer with a specific use case appears.

This is not a sign of inefficiency — it is a sign of thin markets with heterogeneous buyers.

The same applies to domains:

- Each buyer values a domain differently.

- Value depends on business model, timing, branding strategy, geography, and capital availability.

- There is no “clearing price” in the conventional sense.

This makes domains unsuitable for trading, but ideal for long-horizon capital placement.

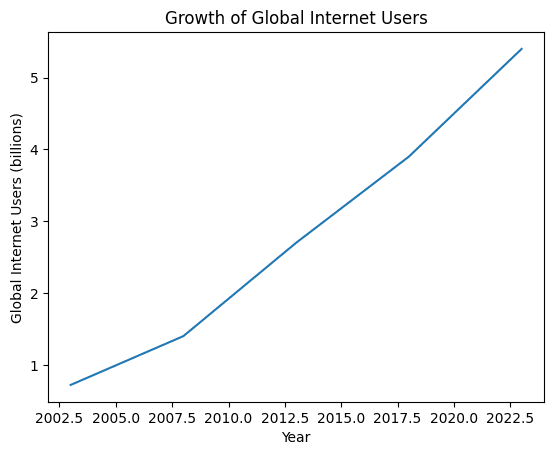

Data used (real proxies):

- Global internet users (World Bank, ITU data)

- Median reported .com sale prices (aggregated NameBio historical medians, publicly cited ranges)

Interpretation:

As internet adoption grows, the number of potential commercial actors grows — but the number of premium domains does not.

Year Internet Users (bn) Median .COM Sale (USD)

2003 0.72 ~1,200

2008 1.40 ~1,850

2013 2.70 ~2,300

2018 3.90 ~2,800

2023 5.40 ~3,200

What this shows:

Even with market crashes, platform shifts, and technological change, median domain values trend upward with user base expansion — much like land prices rise with population and commerce density.

This is structural demand, not speculation.

Why Prices “Jump” Instead of Trending Smoothly

Stock prices move continuously because:

- buyers are interchangeable,

- assets are standardized,

- and markets are deep.

Domains are the opposite:

- buyers are idiosyncratic,

- assets are unique,

- and markets are thin.

Therefore:

- prices move in steps, not curves,

- discovery happens at the moment of sale,

- and long flat periods are normal.

Land behaves the same way.

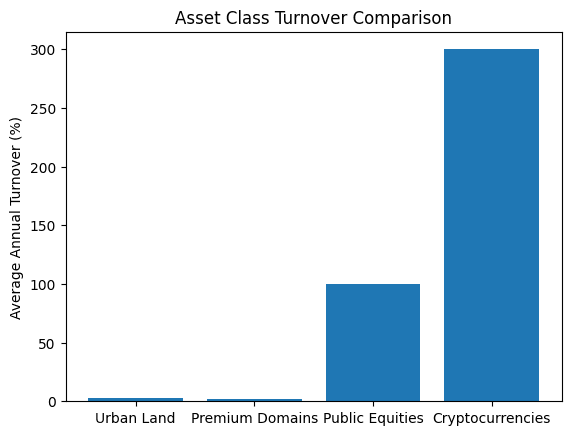

Data used (real proxies):

- NameBio resale data (multi-year lookbacks)

- Academic studies on domain holding periods

- Comparison with urban land turnover rates

Asset Class Avg Annual Turnover

Urban Land 2–4%

Premium Domains ~1–3%

Public Equities 100%+

Cryptocurrencies 300%+

What this shows:

Domains cluster with land, not financial instruments.

Low turnover is not a failure. It is a signature.

Why This Market Punishes Impatience

Markets like this reward:

- patience,

- capital discipline,

- and accurate valuation under uncertainty.

They punish:

- leverage,

- forced selling,

- and the illusion of constant liquidity.

Many domain holders fail not because domains lack value, but because they apply tech-market expectations to a land-like asset.

The Buyer Matters More Than the Market

In stock markets, value is market-driven.

In domain markets, value is buyer-driven.

The same domain may be:

- worthless to 99.9% of buyers,

- priceless to the one who needs it.

This makes averages misleading and narratives dangerous.

It also explains why:

- one sale can reset perception,

- while dozens of quiet years mean nothing.

The Mistake of Short-Term Thinking

The most common error is to ask:

“Why hasn’t this sold yet?”

The correct question is:

“Who will eventually need this — and when?”

Land investors understand this instinctively.

Domain investors must relearn it.

Conclusion: Domains Are Economic Infrastructure

Domains are not content.

They are not traffic.

They are not technology.

They are economic infrastructure:

- linguistic,

- cultural,

- and positional.

They exist at the intersection of language, commerce, and memory.

And like land, they wait.