The secondary domain market is entering its fourth decisive phase. The first era (1995–2000) established names as digital coordinates. The second (2000–2010) professionalized drop-catching, parking, and auctions. The third (2010–2020) normalized end-user acquisitions and BIN rails across marketplaces. The fourth era—2025 to 2035—is defined by instant liquidity, machine-assisted price discovery, and a return to scarcity framed not by hype cycles but by hard linguistic limits. The maturing aftermarket won’t look like a casino; it will look like a yield-seeking, data-referenced market in durable words.

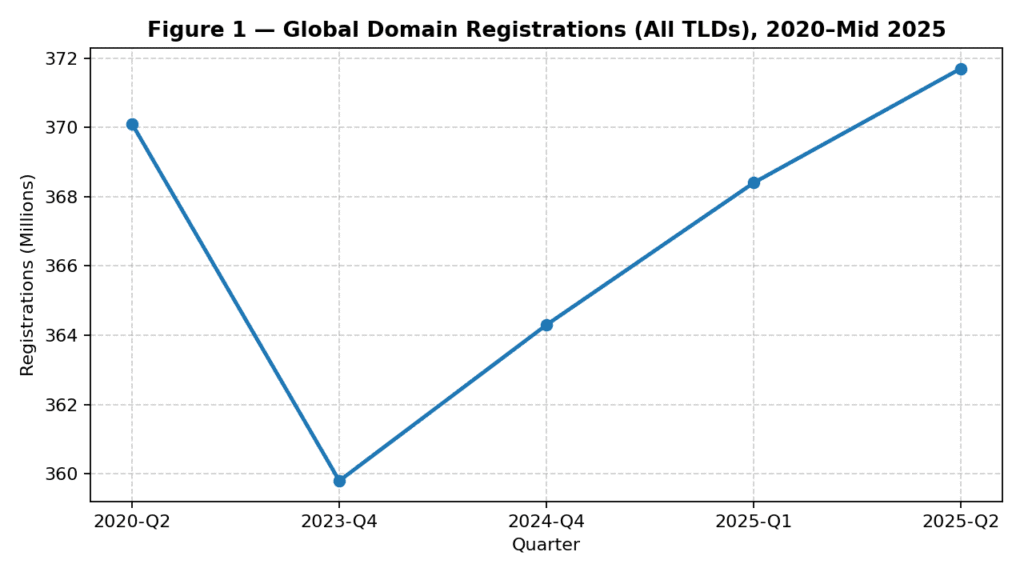

The broad DNS continues to grow. Across all TLDs, global domain registrations rose from 359.8 million at the end of Q4 2023 to 371.7 million by Q2 2025—steady, not explosive growth, but the kind that supports an aftermarket’s baseline demand and turnover. Verisign Blog+1 This backdrop matters: the secondary market lives off net new builders (SMBs, startups, product launches) and portfolio churn among investors. When the registry layer grows, the aftermarket can refine pricing rather than fight gravity.

1) Liquidity is getting instant—and “good names” clear faster

Marketplace rails keep compressing time from discovery to completion. BIN prevalence, syndicated inventory (MLS), and programmatic transfer have turned once-manual transactions into fulfilled orders. The effect is qualitative: sellers who set rational ask prices based on comparable sales (by length, semantics, and category fitness) are rewarded with velocity; unrealistic asks are increasingly ignored, not negotiated. Marketplaces increasingly resemble structured order books, not bargaining tables.

Three liquidity shifts to watch:

- Syndication depth: More inventory is mirrored across partner registrars where buyers already are, reducing friction. (SedoMLS figures highlighted this pattern for years; 45% of sales via partners was noted in recent reporting.) Domain Name Wire | Domain Name News

- BIN culture: A growing share of sales are Buy-Now rather than make-offer. This reduces tail risk for sellers and reconditions buyer expectations around price anchors. Domain Name Wire | Domain Name News

- Escrow UX: Seamless, API-driven escrow and fast-transfer integrations collapse the perceived risk window, which especially benefits corporate buyers who must justify procurement timelines.

For portfolio strategy, this means: a smaller edge for negotiation prowess; a larger edge for pre-pricing quality names correctly. If you want fast rotation, you don’t hunt whales—you publish fair numbers and let distribution do the work.

2) AI valuation: a compass, not an oracle

Automated appraisals have long existed, but the new wave isn’t about single “prices”—it’s about feature-aware comparables. Modern models can condition on orthography (length, pronounceability), semantics (embedding proximity to commercial intents), historical comps within narrowly-defined clusters (5–12 letters, two-syllable, brandable vs. exact-match), and landing-page telemetry.

Two things will happen:

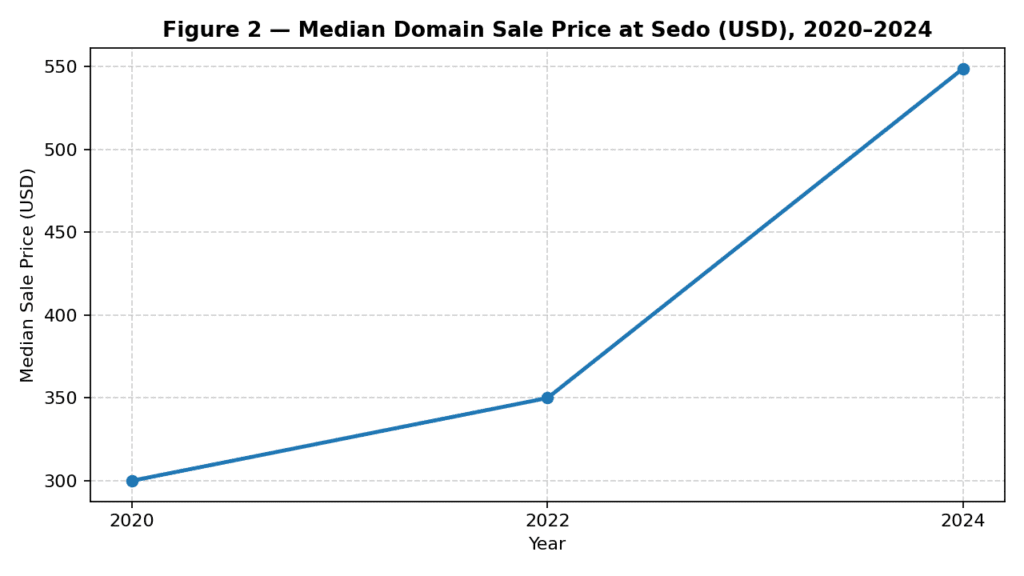

- Spread compression for mid-tier inventory. As comps become transparent, mid-market names (say $2k–$15k) will converge around tighter bands. This is already visible in reported medians: the Sedo median moved from about $300 in 2020 to $350 in 2022 and $549 in 2024, reflecting both mix and channel effects, but also broader adoption of BIN rails and data-anchored pricing. SIDN – Het bedrijf achter .nl+2Domain Name Wire | Domain Name News+2

- Premium remains human. One-word .coms, strong two-syllable coinages, perfect category generics—these will still price through human judgment, timing, and leverage. Models can cluster them; they cannot create substitute scarcity.

Implication: let machines narrow your uncertainty on the long tail; reserve human energy for the small set of assets where narrative and timing create step-changes in value.

3) Digital scarcity: the linguistic ceiling

The ultimate constraint in naming is language itself. Across Latin-script markets, the inventory of crisp, brandable, short tokens is finite. That constraint collides with a world that keeps launching products—especially AI-native tools that must be memorable without advertising budgets. The aftermarket will continue to internalize this: brevity and clarity compound, while long names fight uphill.

That scarcity is visible in buyer behavior: an SMB may accept a longer name in the ccTLD of its home market, but when product scope crosses borders, .com absorption resumes. The DNS data show consistent, modest growth in the underlying system—359.8M (Q4 2023) → 364.3M (Q4 2024) → 368.4M (Q1 2025) → 371.7M (Q2 2025)—but scarcity is not about totals; it’s about the subset of names that can carry a category. Verisign Blog+3Verisign Blog+3Domain Name Industry Brief (DNIB)+3

4) The shape of price discovery, 2025–2030

Price discovery will bifurcate:

- Transparent mid-tier: $2k–$15k asks will be disciplined by comps and time-to-sale metrics. Investors who publish fair BINs and remove counterproductive “ego uplift” will free working capital and outperform.

- Narrative-driven top-tier: Premium one-word .coms and exact-match category leaders will trade less often, but at higher multiples. Their realized prices will increasingly correlate with category health (e.g., AI infra, developer tools, fintech rails) rather than surface metrics like raw search volume.

Watch for institutional behaviors: domain baskets used as GTM leverage for product studios, securitized pools for income streams (leasing), and fund structures that borrow from collectibles finance. These will require clearer data disclosures (hold periods, liquidity windows, comps), which further normalizes pricing.

5) Geography: the return of national namespaces

Expect renewed attention to ccTLDs where digital sovereignty and trust are salient. Germany’s .de has long been a professional standard; France, Poland, the Nordics, and Central Europe will continue to show strong domestic adoption, especially for SMEs selling locally. Steady ccTLD growth is present in the aggregate data for 2024–2025. Domain Name Industry Brief (DNIB)+1

For investors, this doesn’t replace .com—it complements it: blue-chip global names remain .com; local category leaders succeed in their national namespaces. Treat them as different mandates.

6) Practical playbooks for 2025–2035

A. Inventory Design

- Barbell: a small set of durable premium names held long; a rotating shelf of mid-tier names priced to clear.

- Length discipline: 5–12 characters performs best for brandables; avoid multi-hyphen, avoid awkward blends.

- Semantic proximity: cluster by commercial verbs/nouns (ship, vault, loom, forge) and by category adjacency.

B. Pricing

- Publish rational BINs on the mid-tier with guardrails from comps (same length, syllables, semantics).

- Review time-to-sale by cohort; cut prices where inventory stalls beyond 12–18 months.

C. Distribution

- Syndicate widely (MLS). Increase probability of being discovered where the buyer already is. Domain Name Wire | Domain Name News

- Optimize landing pages for decision clarity: brand mockups and category use-cases beat generic “for sale.”

D. Capital

- Measure IRR per cohort, not per anecdote. Redeploy proceeds into obviously scarce names; kill vanity asks.

E. End-user path

- If you’re the buyer, pay for time: choose a name that reduces your CAC curve. The right name amortizes itself across years of marketing.

7) Outlook, 2025–2035

- Liquidity: faster, more programmatic, “one-click” escrow.

- Valuation: comps and machine assistance standardize mid-market pricing, but do not commoditize true premium.

- Scarcity: linguistic constraints tighten; short brandables and exact-match generics continue to compound value.

- Institutions: slow, but inevitable entry via basket strategies and income products.

- Geography: ccTLD steadiness; .com remains the global flagship asset.

The secondary domain market won’t be a frenzy; it will be an orderly search for durable words—short, clear, and commercially fit—and the rails will reward discipline over theatrics.